Right, before you even think about putting the key in the ignition, we need to talk about the one thing that keeps your grand adventure from hitting a major pothole. Road trip insurance isn't just another boring policy; think of it as your indispensable co-pilot, the one who’s ready for any unexpected detour life throws at you. Your standard car or travel cover often has some serious blind spots, which is exactly why getting a specialised policy is non-negotiable for genuine peace of mind.

Why Your UK Road Trip Needs Special Insurance

There’s nothing quite like the buzz of planning a self-drive tour. The freedom, the spontaneity, the promise of hidden gems just around the next bend. Amidst all that excitement, it’s all too easy to just assume your existing car and travel policies have got your back. Honestly, that’s an assumption that could end up costing you dearly.

The trouble is, standard insurance policies tend to live in their own little worlds. Your car insurance is all about the vehicle itself, and a general travel policy might cover a cancelled flight or a lost suitcase at the airport. Neither was ever really designed to handle the unique mix of challenges that a driving holiday presents.

Bridging the Critical Gaps in Your Cover

This is where specialised road trip insurance comes in. It’s built to be a complete safety net, neatly filling all the gaps left by your other policies. It’s like having a proper, fully-stocked first-aid kit for your entire journey, not just a few plasters for one part of it.

This isn’t just a niche concern, either. The growing demand for solid protection is a trend we're seeing across the board. The UK travel insurance market is already worth around £476 million and is expected to hit £610 million by 2030. This tells us one thing loud and clear: people are wising up to the need for proper travel protection. If you're curious, you can explore more insights about this trend and its impact on UK travellers.

A dedicated road trip policy brings together different types of cover into one, seamless package. It’s designed specifically for the challenges you face when your holiday is on wheels, protecting you from the moment you leave your driveway to the moment you return.

To give you a clearer picture, here’s a quick rundown of the essential protections you'll typically find in a comprehensive road trip policy.

Key Protections in a Road Trip Policy

| Coverage Type | What It Protects You Against |

|---|---|

| Trip Cancellation & Curtailment | Losing money on pre-booked hotels or activities if your car breaks down or you have to cut the trip short for a covered reason. |

| Car Hire Excess Insurance | The massive excess charge (often over £1,000) you'd have to pay if your hire car gets damaged or stolen. |

| Personal Belongings Cover | Theft of your valuable gear—laptops, cameras, luggage—from your vehicle, a common weak spot on driving holidays. |

| Breakdown Assistance | Getting stuck at the roadside. This is vital for European trips where your standard UK cover might not reach. |

At the end of the day, these elements work together to provide a robust financial backstop for the most common road trip disasters.

Ultimately, picking the right road trip insurance isn’t just about ticking a box. It's about buying yourself the freedom to truly enjoy the open road, knowing you’re covered no matter what.

Understanding Your Core Coverage

Think of your road trip insurance policy as a well-stocked toolbox. Just having the box isn't much help; you need to know exactly what each tool is for and when to pull it out. A really solid policy is built on a few essential pillars of protection, each one designed to handle a specific kind of roadside disaster. Let's open it up and see what’s inside.

The first and most fundamental tool is Medical Emergency Cover. You might feel secure with your NHS card for trips within the UK, but this cover becomes absolutely vital the moment you drive onto a ferry or through the Channel Tunnel. It isn't just for major accidents. Imagine coming down with a sudden illness that lands you in a European hospital, chipping a tooth on some local delicacy, or needing to be flown home for medical reasons. This is the safety net that stops a health problem from becoming a devastating financial one.

Next up is Trip Cancellation and Curtailment Cover. This is your financial backstop against all those frustrating "what ifs."

Picture this: you've pre-paid for a week of charming cottages in the Cotswolds and even splurged on non-refundable tickets for a festival. Then, just two days before you're set to leave, a family emergency strikes, or your car's engine gives up the ghost. Without this cover, all that money is simply gone. Cancellation cover is what reimburses you for those pre-paid, non-refundable expenses.

Protecting Your Plans and Possessions

Just as crucial is Personal Belongings Cover. Your car on a road trip is essentially a mobile locker for your most valuable gear—laptops, cameras, tablets, and all your luggage. Standard car insurance usually offers very limited cover for things stolen from your vehicle, and your home insurance might not cover items left in a car overnight at a hotel. Road trip insurance is designed specifically for this common risk, giving you the confidence to park up and explore a new town or check into your B&B without worry.

These three elements are the bedrock of any decent road trip policy. It’s worth remembering, though, that this type of insurance is focused on the journey itself. It's often smart to think about other protections, like understanding warranty insurance options, which can help with unexpected repair bills that your travel policy won't cover.

To break it down, here’s what you're looking for:

- Medical Emergencies: Covers you for unexpected illness or injury. It’s an absolute must for European travel where you're outside the NHS system.

- Trip Cancellation: Protects the money you've invested in non-refundable bookings if you’re forced to cancel or cut your trip short for a valid reason.

- Personal Belongings: Insures your valuable kit against theft from your vehicle, filling a gap often left by other standard policies.

Once you get your head around these core components, you can see past the confusing jargon and start to properly judge whether a policy offers the real-world protection your adventure truly needs.

How Car Hire Excess Insurance Can Save You Money

When you're about to set off on one of our amazing self-drive tours, the last thing you need is a high-pressure sales pitch at the car hire desk that leaves you flustered and out of pocket. Yet, that's exactly what happens to so many travellers.

Think of the standard insurance that comes with your hire car. It has a catch. Buried in the small print is a huge deductible that you're on the hook for if anything goes wrong. This is the car hire excess. It’s the fixed amount the hire company will charge your credit card for damage or theft, no matter whose fault it was. A single misplaced trolley in a car park could suddenly leave you with a bill for over £1,500.

What Is Car Hire Excess, Really?

This excess amount isn't an accident; it’s often set deliberately high. It's a tactic that allows hire companies to advertise tempting low daily rates, knowing they can pressure you into buying their own expensive excess waiver policy at the counter. These policies can easily double the original cost of your car hire.

This is where a standalone Car Hire Excess Insurance policy becomes your best friend. It’s a separate, much cheaper policy you buy before you travel. If you have a mishap and the hire firm charges you the excess, you simply pay them and then claim the entire amount back from your own insurer.

This simple step transforms a potentially holiday-ruining expense into a manageable inconvenience. You can confidently decline the overpriced waiver at the rental desk, knowing you have comprehensive protection for a fraction of the cost.

What Does It Typically Cover?

A good policy is designed to cover all the common bits and pieces that the hire company’s basic insurance often excludes. It’s a real safety net.

Look for cover that includes reimbursement for excess charges related to:

- Bodywork: Scratches, dings, and dents on the car's panels.

- Windscreen and Glass: Chips and cracks in the windscreen, windows, or mirrors.

- Tyres and Wheels: Punctures or costly damage to the tyres and alloy wheels.

- Roof and Undercarriage: Damage from uneven roads or high kerbs, which is surprisingly common.

It's interesting to note that awareness of these specific insurance needs can differ. A 2020 survey revealed that while older travellers are generally more likely to buy travel insurance, younger adults often have lower uptake rates. This points to a potential awareness gap around hidden costs like hire car excess. You can read more on travel insurance trends in the UK to see the data for yourself.

Ultimately, sorting out your excess insurance in advance is one of the smartest and simplest money-saving moves you can make for any road trip.

Single Trip vs. Annual Policies: Which is Right for You?

So, you're getting ready to hit the road. One of the first practical decisions you'll need to make is about your insurance. The right choice really boils down to your personal travel style. Are you planning one big, epic driving holiday this year, or are you the type who takes off on several shorter adventures whenever you get the chance?

Your answer will point you directly to either a single-trip or an annual policy. Let's break down what they are and who they're for.

A single-trip policy is exactly what it sounds like – it provides cover for one specific trip. You set the start and end dates, and that's the period you're insured for. Simple. This is the perfect, no-fuss option if you've got one main road trip on the calendar for the year.

Then you have the annual multi-trip policy. This covers you for a full 12 months, meaning any trip you take during that year is insured. There's usually a cap on the length of any single trip (often around 31 days), but for the serial weekend-breaker or frequent road-tripper, it’s a game-changer in terms of both value and convenience.

Making the Smart Financial Choice

Honestly, the best way to decide is to look at your calendar for the next twelve months. It usually comes down to a simple bit of maths.

As a rule of thumb, if you're planning two or more road trips in a year, an annual policy will almost certainly save you money. The initial cost is higher than for a single trip, but it's usually much cheaper than buying two or more separate policies.

It's not just about the money, either. Think of the time and hassle saved by not having to arrange fresh cover every time you want to get behind the wheel. Imagine you're planning a fantastic Taste of England 8-Day Self-Drive Tour for the summer, but you also fancy a quick weekend trip to the Scottish Highlands a few months later. In that scenario, an annual policy is a clear winner.

What Goes Into the Price of Your Policy?

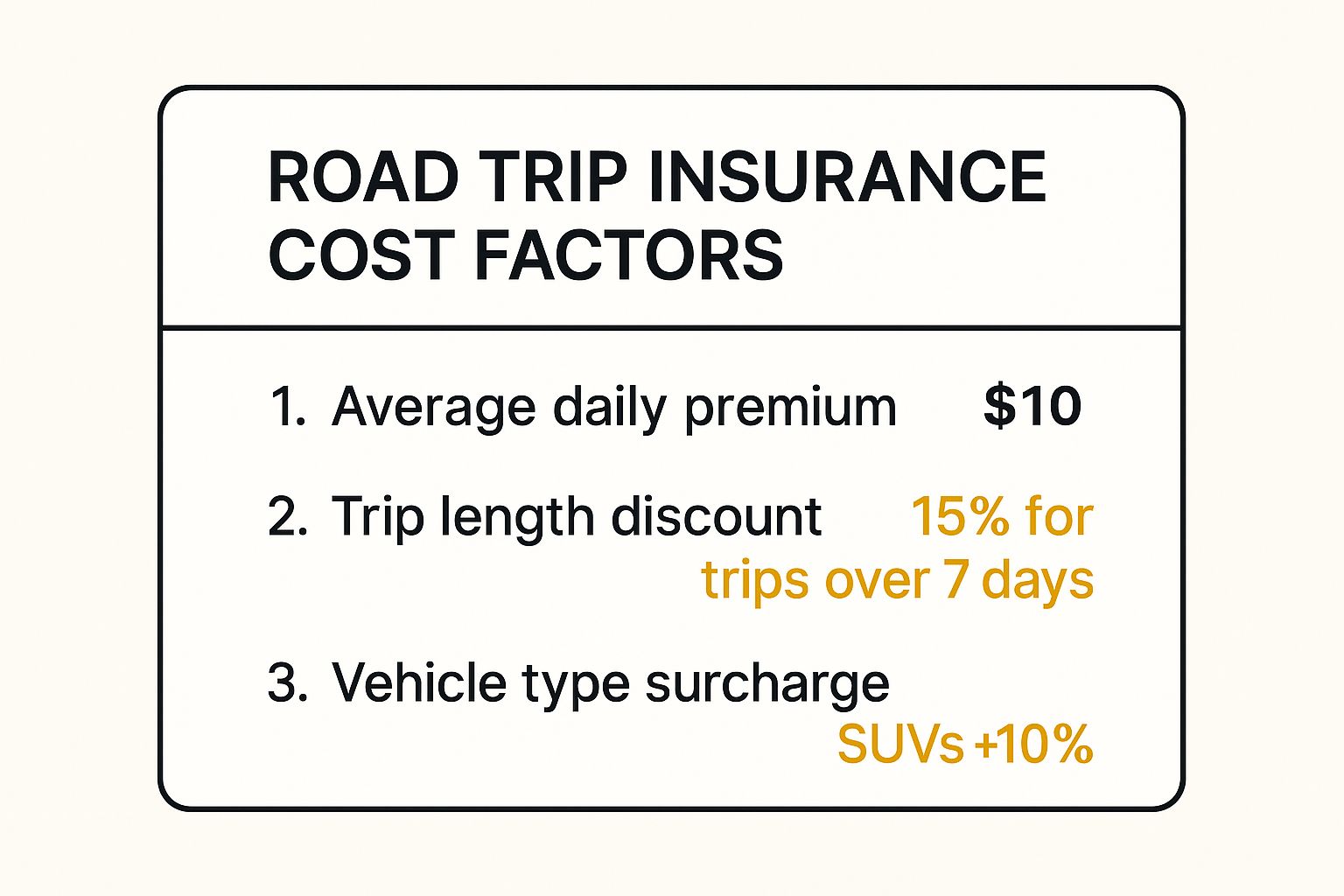

To give you a better idea of what affects the cost, have a look at the key factors that can push your insurance premium up or down.

As you can see, things like your age, destination, and even the type of car you're driving all play a part. Keep these in mind alongside how often you travel to find the most cost-effective cover for your adventures.

To make it even clearer, here’s a quick comparison to help you decide which policy type fits your needs.

Single Trip vs Annual Policy: Which Is Right For You?

| Feature | Single-Trip Policy | Annual Multi-Trip Policy |

|---|---|---|

| Best For | One-off holidays or infrequent travellers. | Frequent travellers taking 2+ trips per year. |

| Coverage Period | Covers a specific, pre-defined trip duration. | Covers all trips within a 12-month period. |

| Cost-Effectiveness | Cheaper for a single journey. | More economical for multiple trips. |

| Convenience | Requires arranging a new policy for each trip. | "Set it and forget it" for an entire year. |

| Trip Length | Flexible; you define the exact number of days. | Each trip is typically capped (e.g., 31 days). |

Ultimately, the best policy is the one that aligns with your travel plans for the year ahead. A single-trip policy offers focused, straightforward cover, while an annual plan provides fantastic value and peace of mind for the regular explorer.

Common Exclusions That Can Invalidate Your Cover

Knowing what your road trip insurance covers is one thing, but understanding what it doesn't cover is arguably even more important. The real devil is in the details—specifically, the exclusions. These are the situations where your policy simply won't pay out, and they can trip up even the most seasoned traveller.

Think of it like a game with a set of rules. If you step outside the boundaries, even by accident, you’re out of the game. That's exactly how insurance exclusions work. It’s not about insurers trying to catch you out; it's about defining the scope of their risk. Your job is to know those boundaries before you hit the road.

I've seen it happen time and time again: travellers assume they're covered for a particular situation, only to face a denied claim. So, let’s dig into the fine print and look at the common pitfalls that could leave you unprotected.

Key Exclusions to Watch For

First up, geographical limits. Your policy document will clearly state which countries are included in your cover. If you get a sudden urge to take a detour across the border into a country that isn't on that list, your insurance cover evaporates the second you cross over.

Another big one is driving under the influence of alcohol or drugs. This is a hard-and-fast rule with zero wiggle room. If you're involved in an accident and it’s determined you were impaired, your insurer will deny any and all related claims. It's a non-negotiable part of every policy out there.

You could say your policy is a partnership. You agree to act responsibly, and the insurer agrees to have your back when things go wrong. Breaking a fundamental safety rule like driving sober is a breach of that trust.

Here are a few more common exclusions that catch people out all the time:

- Unattended Valuables: Leaving your laptop on the back seat is an open invitation to thieves. Most policies won’t cover theft from your vehicle unless your belongings were locked away securely and out of sight, like in the boot or glove compartment.

- Off-Road Driving: Dreaming of taking that scenic, unpaved mountain pass? You'd better check your policy. Many standard insurance plans specifically exclude any damage or incidents that happen on non-tarmacked roads.

- Undeclared Medical Conditions: This is a huge one. Forgetting to declare a pre-existing health condition, even one you think is minor, can void your medical cover entirely. Honesty is absolutely the best policy when you’re applying.

Understanding these exclusions isn't meant to put a damper on your adventure. It's about making sure your plans and your protection are perfectly aligned. For a more detailed look at how these general rules apply, you can always check out our terms and conditions. A little bit of reading now can save you a massive headache later.

How to Compare Policies and Find the Best Value

https://www.youtube.com/embed/TQ1_BY3F8U8

Navigating insurance quotes can often feel like you're comparing apples and oranges. The trick isn't just to snag the cheapest deal, but to find genuine value that gives you proper peace of mind on the road. Let's break down how to compare policies effectively, so you can look past the headline price and find cover that you can actually rely on.

Comparison websites are a fantastic starting point. They give you a brilliant, at-a-glance view of the market. But treat them as a launchpad, not the final word. The real work starts when you dig into the details behind that tempting low price.

This is where you need to get forensic with the policy documents. Zero in on three critical figures: the medical cover limit, the cancellation cover amount, and the personal belongings limit. Are these figures realistic for your trip? A policy that’s a fiver cheaper is no bargain if it only offers £500 of cancellation cover when you've already paid £1,500 for hotels and car hire.

Look Deeper Than the Price Tag

The next thing to hunt down is the excess. This is simply the amount you have to contribute towards any claim you make. A policy might look incredibly cheap until you discover it has a £250 excess. That initial saving vanishes the moment you need to make a small claim. Often, a slightly pricier policy with a more manageable £50 excess offers far better value in the long run.

It’s also absolutely essential to declare any pre-existing medical conditions. I know it's tempting to keep quiet to get a lower quote, but non-disclosure can void your entire policy just when you need it most. Insurers base their cover on an accurate assessment of risk, and complete honesty is the only way to guarantee they'll be there for you.

Finding the right road trip insurance isn't a race to the bottom on price. It's an exercise in matching the cover to your journey's reality, ensuring your safety net has no holes when you need it most.

Your Quick Comparison Checklist

Before clicking 'buy', run each potential policy through this quick checklist. It helps you compare them like-for-like and highlights where the true value lies.

- Excess Amount: How much will you pay out of pocket for a claim? Is it a figure you're comfortable with?

- Cover Limits: Do the limits for medical, cancellation, and baggage actually cover the potential costs of your trip?

- Customer Reviews: What are people really saying? Focus on feedback about the claims process, not just how easy it was to buy.

- Medical Declarations: Have you been 100% upfront about any and all pre-existing health conditions?

- Geographical Area: Double-check that the policy covers every single country you plan to visit, even if you're just driving through.

Taking this structured approach moves you from being baffled by quotes to confidently choosing a solid road trip insurance policy. At the end of the day, you're buying confidence, not just a piece of paper.

Still Have a Few Questions? Let's Clear Things Up

It's completely normal to have a few questions rattling around even after going through all the details. To make sure you feel confident and ready for your trip, we’ve tackled some of the most common queries we hear from fellow road trippers.

Is My Regular Car Insurance Enough for a European Road Trip?

In a word, no. While your UK car insurance policy is legally required to provide basic third-party cover across the EU, this is just the bare minimum. It almost certainly won’t include the comprehensive protection you’re used to at home, leaving you exposed to the costs of theft, damage, or breakdown.

Even more importantly, your car insurance provides zero cover for everything else that makes up your holiday. Think cancelled hotels, unexpected medical bills, or lost luggage – none of that is included. A proper road trip insurance policy is designed to plug all these critical gaps.

What’s the Real Difference Between Travel and Road Trip Insurance?

Standard travel insurance is typically designed with fly-and-flop holidays in mind, which means it often doesn't fully appreciate the unique risks of a driving holiday. A specialised road trip insurance policy is built from the ground up to offer more robust and relevant protection for when you're behind the wheel.

It comes with features specifically for drivers, such as:

- Higher limits for car hire excess, protecting you from the potentially huge fees rental companies can charge if there's an incident.

- Dedicated European breakdown assistance to ensure you aren't left stranded on a motorway hundreds of miles from home.

- Cover for taking your own car abroad, a scenario many standard travel policies simply don't allow for.

It’s a policy fine-tuned for the realities of a self-drive adventure.

Think of it like this: a standard travel policy is a decent multi-tool, but a road trip policy is the specialist equipment you need to get the job done right when your entire trip revolves around a car.

Do I Genuinely Need Insurance for a Road Trip Within the UK?

Yes, it's a very good idea. While your car insurance handles the vehicle and the NHS takes care of your health, neither protects the money you've invested in the holiday itself.

This is where road trip insurance proves its worth. It can reimburse you for non-refundable hotels or event tickets if you're forced to cancel because of a sudden illness or a serious breakdown. It also covers your personal belongings if they’re stolen from your car – a vital benefit when your vehicle is packed with luggage and gear.

Ready to hit the open road with total peace of mind? BTOURS crafts unforgettable self-drive tours across the UK and beyond, and we can help you find the perfect protection for your journey.

Discover your next adventure with us at https://www.btours.com.